Thinking about taking your business global in 2025? You’re not alone. Cross-border trade is booming—but here’s the secret: most businesses fail not because they lack ambition, but because they miss the systems that make global trade work.

That’s where cross-border business trade solutions come in. These tools and services don’t just help you export—they help you scale smartly, legally, and profitably.

In this Article

Why Cross-Border Trade Is the Smartest Move Right Now

According to recent data, over 22% of global e-commerce transactions are now cross-border—and growing. But success isn’t just about launching a product in another country. It’s about solving five key challenges that many businesses overlook.

Here’s what they are—and how the right cross-border solutions can help you win:

Check Out: Should NRIs Get Insurance in India? Discover the Smart Reasons Why Many Do

1. Understand the Market Before You Dive In

Expanding into a new country means learning:

- Local consumer behavior and cultural norms

- Business laws and import/export regulations

- Taxes, tariffs, and documentation requirements

Trade solution partners can guide you through this maze with market insights, compliance support, and multilingual website tools to help you localize your brand.

2. Tame the Paperwork Monster

Every international transaction involves:

- Export bills

- Customs clearance forms

- Regulatory filings (like eBRC, FIRS, etc.)

Banks like ICICI Bank now offer digital Export Bill Regularisation, letting you:

- Match remittances with shipment details

- File documents online without visiting branches

- Get automated compliance certificates

- Track incentives and rebates faster

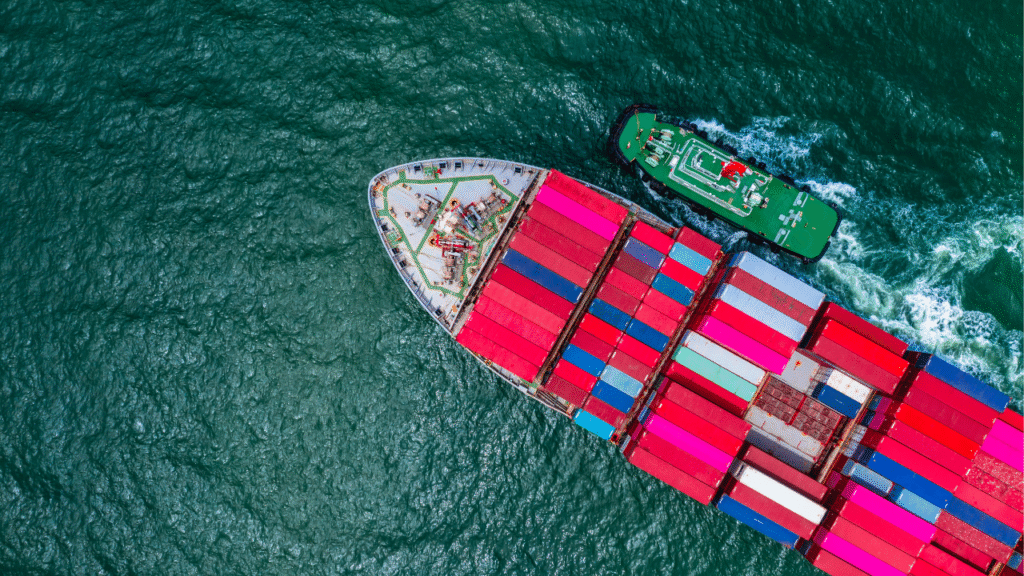

3. Fix the Global Logistics Puzzle

Shipping internationally? You’ll need:

- A reliable network of carriers

- Tracking across multiple countries

- Efficient route planning

- Help with customs and last-mile delivery

Cross-border logistics platforms now offer multi-carrier comparison tools and even on-ground partners to handle communication and paperwork abroad.

4. Solve the Funding Gap

The gap between exporting a product and getting paid can crush your cash flow. That’s why scalable trade depends on:

- Pre-shipment financing to fund manufacturing

- Post-shipment financing to keep cash flowing

- Flexibility for large-volume orders

Look for partners who offer fast, unsecured, and MSME-friendly trade finance solutions.

Check Out: Best Legal Apps to Watch Indian TV in the USA: Stream Seamlessly Without VPNs

5. Don’t Forget Quality and Returns

Global customers are picky. They expect:

- Premium product quality

- Competitive pricing

- Fair and easy return policies

Offering a transparent return process builds trust and improves conversion—even from first-time international customers.

6. Get Payment Right (Or Risk Losing Customers)

Cross-border payments come with:

- Currency exchange confusion

- High transaction charges

- Country-specific compliance laws

Use authorized dealers or OPGSP platforms to manage payments securely, affordably, and with real-time tracking.

Check Out: How Do Indians Abroad Handle Cooking Odor Complaints and Fire Alarms Effectively

FAQs: Cross-Border Business Trade Solutions

1. What exactly are cross-border business trade solutions?

These are services, tools, and platforms designed to help businesses sell products or services in foreign markets. They cover everything from legal compliance and logistics to financing and payment processing.

2. Is cross-border trade only for large companies?

Not at all. MSMEs and startups are entering global markets with the help of low-cost, digital-first cross-border solutions, making international trade more accessible than ever.

3. How can I get financing for exports?

Banks like ICICI offer pre- and post-shipment finance tailored for exporters. These help cover manufacturing costs, shipping, and cash flow gaps until you receive payments from international buyers.

4. What’s the biggest challenge in cross-border trade?

Compliance and logistics are often the most difficult aspects. Without proper documentation or the right shipping partners, products may be delayed, penalized, or returned.

5. Can I use local payment gateways for international sales?

Not always. For proper foreign exchange compliance and better transaction success rates, use an Authorized Dealer bank or platforms approved under OPGSP (Online Payment Gateway Service Provider) guidelines.

Scaling globally is no longer a luxury—it’s a growth strategy. But if you’re serious about going global in 2025, you need more than ambition. You need the right cross-border business trade solutions backing every step you take.

Don’t just ship globally—scale wisely.