For Non-Resident Indians (NRIs) looking to build or manage financial assets in India, understanding the importance of a Permanent Account Number (PAN) card is crucial. Whether it’s investing in mutual funds, buying property, or opening bank accounts, a PAN card acts as your financial identity in India. This guide explores how a PAN card helps NRIs navigate the Indian investment landscape smoothly and legally.

What is a PAN Card and Why is it Important for NRIs?

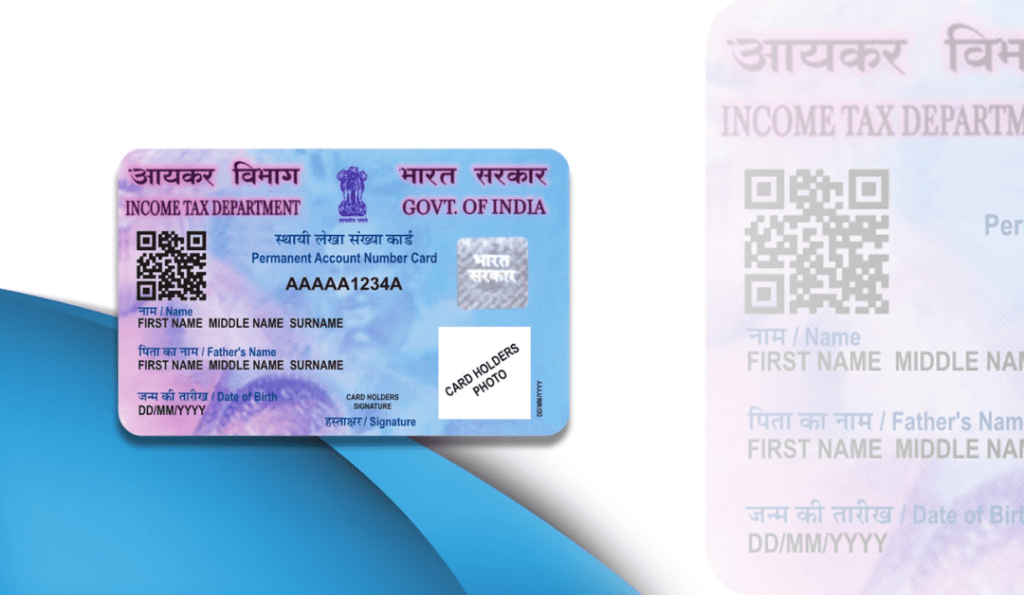

A PAN (Permanent Account Number) card is a 10-digit alphanumeric identifier issued by the Income Tax Department of India. It’s not just for taxpayers—it’s a mandatory requirement for anyone conducting high-value financial transactions in India, including NRIs.

For NRIs, the PAN card serves multiple key purposes:

- It establishes identity in financial and tax systems.

- It’s mandatory for most types of investments.

- It ensures compliance with Indian tax regulations.

- It helps avoid higher TDS (Tax Deducted at Source) on income earned in India.

1. Investing in Mutual Funds and Stock Market

NRIs can invest in Indian mutual funds and stocks through the Portfolio Investment Scheme (PIS), which is regulated by the RBI. A PAN card is a prerequisite for:

- Opening a Demat and trading account with SEBI-registered brokers.

- KYC (Know Your Customer) compliance for mutual fund investments.

- Tax reporting and TDS calculations.

Without a PAN card, mutual fund companies and stockbrokers will not process your investment applications.

2. Buying Property in India

Whether you’re buying residential or commercial real estate, having a PAN card is mandatory if:

- The transaction value exceeds ₹10 lakh.

- You’re selling the property and need to report capital gains.

- You’re paying taxes on rental income earned from Indian properties.

Tip: A PAN card is required even if the property is jointly held or inherited.

3. Opening NRE/NRO Bank Accounts

Most banks in India require a PAN card when NRIs open:

- NRE (Non-Resident External) accounts – for income earned outside India.

- NRO (Non-Resident Ordinary) accounts – for income generated in India (like rent, dividends, etc.).

Having a PAN card simplifies compliance and prevents higher TDS deductions on your interest income.

4. Filing Income Tax Returns in India

If an NRI earns any income in India—through rent, interest, capital gains, or dividends—they may be liable to file an Income Tax Return (ITR).

- A PAN card is mandatory to file ITR in India.

- It helps you claim tax deductions and refunds.

- It ensures proper reporting of financial activities to the Income Tax Department.

5. Avoiding Higher TDS Rates

If NRIs do not have a PAN card, TDS on certain transactions can be deducted at a higher rate (up to 20%). This applies to:

- Sale of property

- Mutual fund redemptions

- Dividend and interest payouts

With a PAN card, you can avoid excess deductions and stay tax-efficient.

6. Ease of Compliance and Financial Management

A PAN card acts as a single-point reference for all your financial dealings in India. It allows seamless:

- Linking of investments with Aadhaar or bank accounts

- Centralized tracking of capital gains and tax credits

- Hassle-free communication with banks and investment institutions

How NRIs Can Apply for a PAN Card

Applying for a PAN card as an NRI is straightforward:

- Visit NSDL or UTIITSL website.

- Fill Form 49AA (for individuals not residing in India).

- Submit necessary documents:

- Passport copy

- OCI/PIO card (if applicable)

- Overseas address proof

- Choose whether to get a physical or e-PAN.

- Track application online.

Whether you’re a seasoned investor or just beginning your investment journey in India, a PAN card is more than a formality—it’s the foundation of your financial identity in India. It unlocks access to markets, ensures tax compliance, and enables smarter wealth management.

Have questions about getting your PAN card as an NRI or starting your investment journey in India? Drop them below, and we’d be happy to help!