The Greater Toronto Area (GTA) real estate market in February 2025 is showing signs of a subtle but significant shift. After years of record-high demand and price volatility, buyers are finally finding themselves with more negotiating power, and sellers are having to recalibrate expectations.

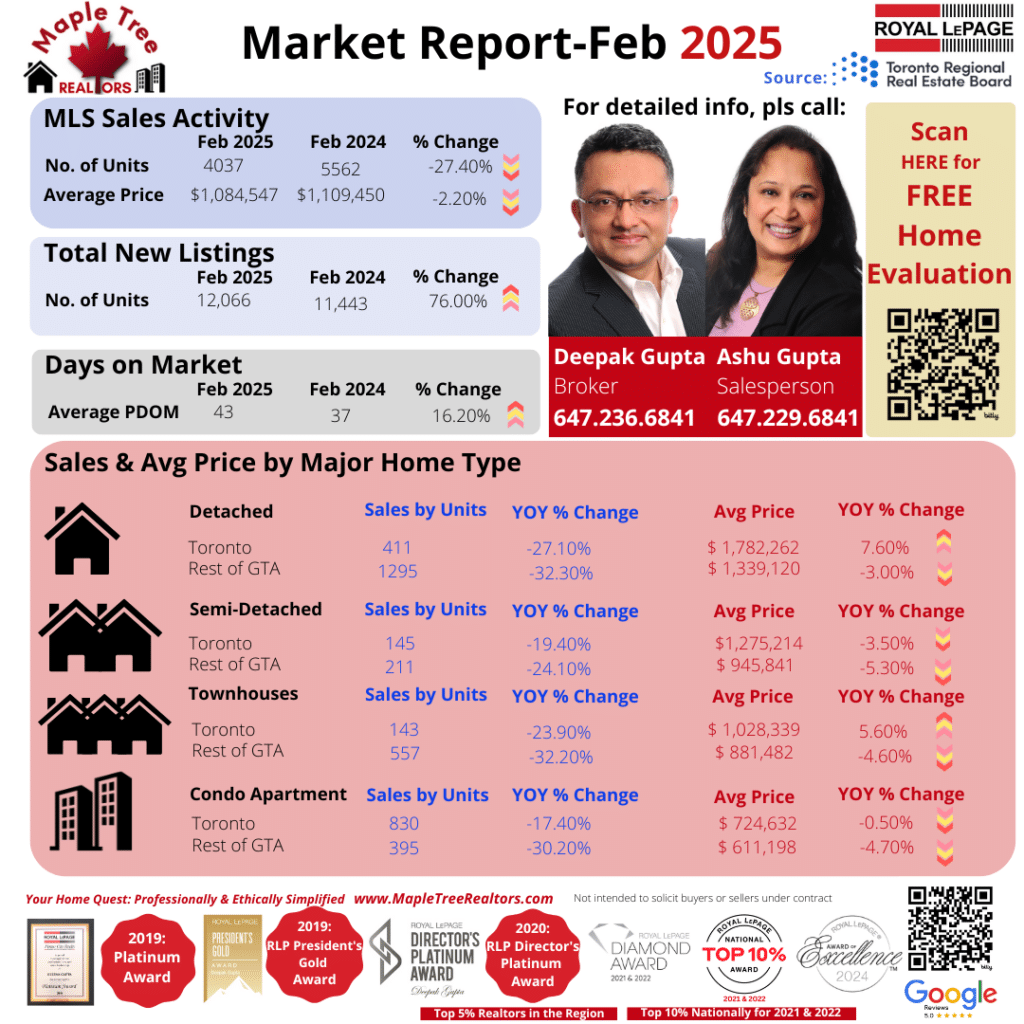

According to the latest data, home sales in the GTA totaled 4,037 units in February, a noticeable 27.4% decline compared to the same month last year. This slowdown reflects the broader market sentiment—buyers are exercising caution, and elevated mortgage rates are tempering enthusiasm. Yet, there’s more to the story than just numbers.

Inventory Is Up, and That Changes the Game

In contrast to falling sales, new listings have increased by 5.4%, reaching 12,066 across the region. This is a welcome shift for buyers who have been battling tight inventory and bidding wars in past years. More supply means more choices—and more leverage for those entering the market now.

The average home price in the GTA currently sits at $1,084,547, marking a 2.2% year-over-year decline. This slight dip, while modest, is a signal that the frenzied pace of price growth has stabilized. The MLS® Home Price Index (HPI) Benchmark also saw a 1.8% drop, reinforcing the notion of a cooling market.

What’s Driving This Change?

Several factors are converging at once. First, higher borrowing costs are keeping some would-be buyers on the sidelines. While the Bank of Canada has paused rate hikes, interest rates remain significantly higher than they were in early 2022, making affordability a real concern—especially for first-time buyers.

Second, economic uncertainty is causing households to be more conservative with major financial decisions. People want clarity on inflation, job stability, and long-term interest rate trajectories before making a move.

However, there’s growing speculation that the second half of 2025 may bring a shift in tone. If the Bank of Canada moves forward with anticipated rate cuts, we could see a renewed surge in demand—especially in entry-level and mid-tier segments.

Looking Ahead: A Market Poised for a Bounce?

While February data suggests a slower market, this could be the calm before a more active spring and summer season. Inventory is rising, prices are slightly correcting, and economic indicators suggest a more optimistic outlook for the second half of the year.

This is particularly relevant for homebuyers who’ve been waiting on the sidelines. If mortgage rates come down and economic confidence rises, the window for “buyer’s market” conditions could close quickly.

For sellers, this is the moment to re-evaluate pricing strategies and position listings competitively. Homes that are well-priced and well-presented are still selling—just not with the same urgency as in previous years.

The Bottom Line

The GTA housing market in early 2025 is more balanced than we’ve seen in a while. While sales volume is down, buyers are gaining ground, and that’s bringing more rationality back into the real estate landscape.

Whether you’re planning to buy your first home, upgrade to a larger space, or list your property in this changing environment, timing and strategy have never been more important.

Need help navigating today’s market?

At Maple Tree Realtors, we specialize in helping GTA buyers and sellers succeed—regardless of the market cycle.

📞 Call Deepak Gupta at 647-236-6841

Or visit mapletreerealtors.com for access to pre-market listings, expert advice, and personalized solutions.